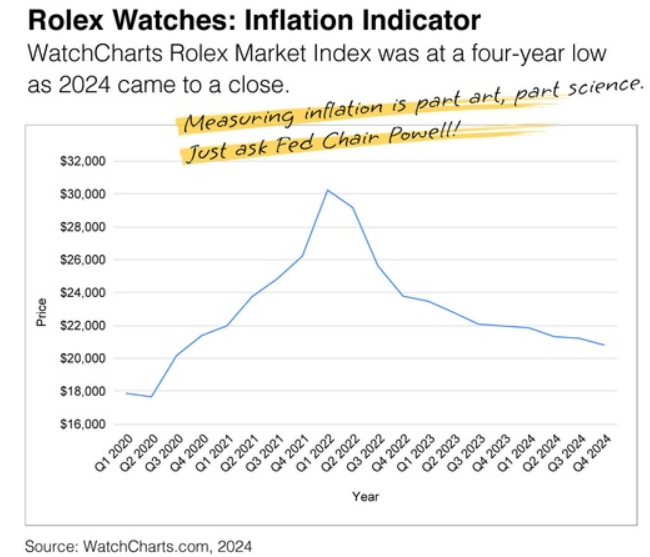

What does the Worldchart’s Rolex indicator say about inflation?

Inflation is a very personal experience.

How it affects you largely depends on the products and services you consistently buy. Over the years, some of you have developed different ways to measure how inflation impacts your daily lives.

For example, one of our colleagues uses the grocery bag indicator. She counts the number of bags of groceries she buys vs. how much money she spends. More money spent for fewer bags = higher inflation. Less money, the same number of bags = lower inflation.

Fed Chair Jerome Powell also has a favorite indicator. It’s called the Personal Consumption Expenditures price index, which he believes better portrays costs for the average American.

One of our new favorite inflation indicators is the WatchCharts Rolex market Index, which shows how much people will pay for Rolex watches in the secondary market. As you can see, the average market price for the index of 30 Rolex watches closed the year at $20,805, the lowest level since Q3 2020.

To us, the Rolex indicator suggests that the worst of inflation is over. And prices, while still higher than before, continue to trend lower steadily. But trends mean little if you’re still experiencing higher prices with the products or services you consistently buy.

Please let us know if you have an inflation indicator you follow. Another friend of ours goes to the mall to see how many people are shopping and carrying bags. He says people always go to the mall (especially in the winter), but he keeps his eye on people who leave with something versus those who only look around.

Inductive logic about the economy's health and inflation, if you ask us!

WatchCharts.com, 2024. “WatchCharts Rolex Market Index.”