401K Millionaires

Saving for retirement requires dedication, focus, and some sacrifice–a three-pronged approach embraced by a greater number of investors!

Nearly 500,000 retirement savers are now 401(k) millionaires, according to Q2 stats compiled by Fidelity Investments. Equally encouraging–of the 48 million Fidelity accounts, the average 401(k) balance was $127,100 in Q2.

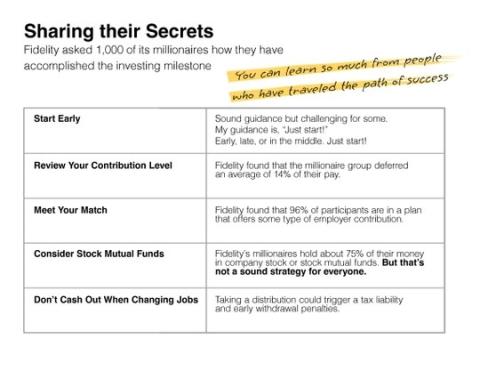

What are the keys to 401(k) success?

Fidelity asked its millionaires, and the answers are some of the same ideas we always talk about!

When we create portfolio strategies, we consider all of your assets, including your company-sponsored plans. If anything changes just let us know. We might need to make some adjustments so you can take advantage of everything you are being offered.

Once you reach age 73, you must begin taking required minimum distributions (RMDs) from your 401(k) or any other defined contribution plan in most circumstances. Withdrawals from your 401(k) or any other defined contribution plans are taxed as ordinary income and, if taken before age 59½, may be subject to a 10% federal income tax penalty.

Investing involves risks and rewards, and investment decisions should be based on your own goals, time horizon and tolerance for risk. This is how Steward works with our clients. If you need help with your 401Ks as part of your overall investment goals, contact us.

InvestmentNews.com, August 28, 2024. “401(k) millionaires reach another record in Q2, says Fidelity”

Fidelity.com/viewpoints, 2024. “Five habits of 401(k) millionaires

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm.